Navan (NAVN)·Q3 2026 Earnings Summary

Navan Q3 FY2026 Earnings: Strong Debut Overshadowed by CFO Exit

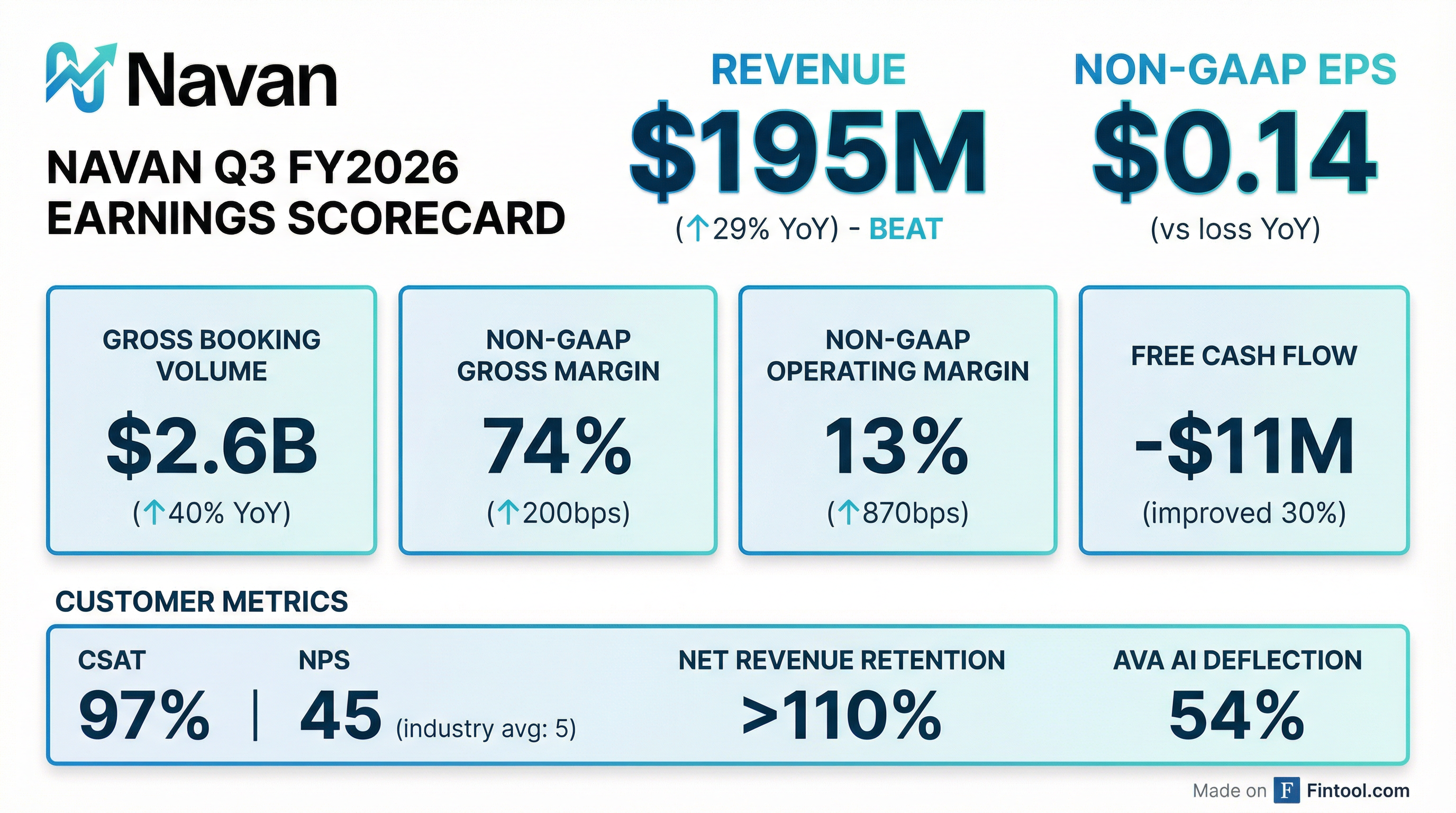

Navan delivered a solid first earnings report as a public company, beating revenue estimates by 5% with 29% YoY growth. However, shares dropped ~8% after-hours following the surprise announcement that CFO Amy Butte will depart in January.

At a Glance

Key Results

Beat/Miss vs Consensus

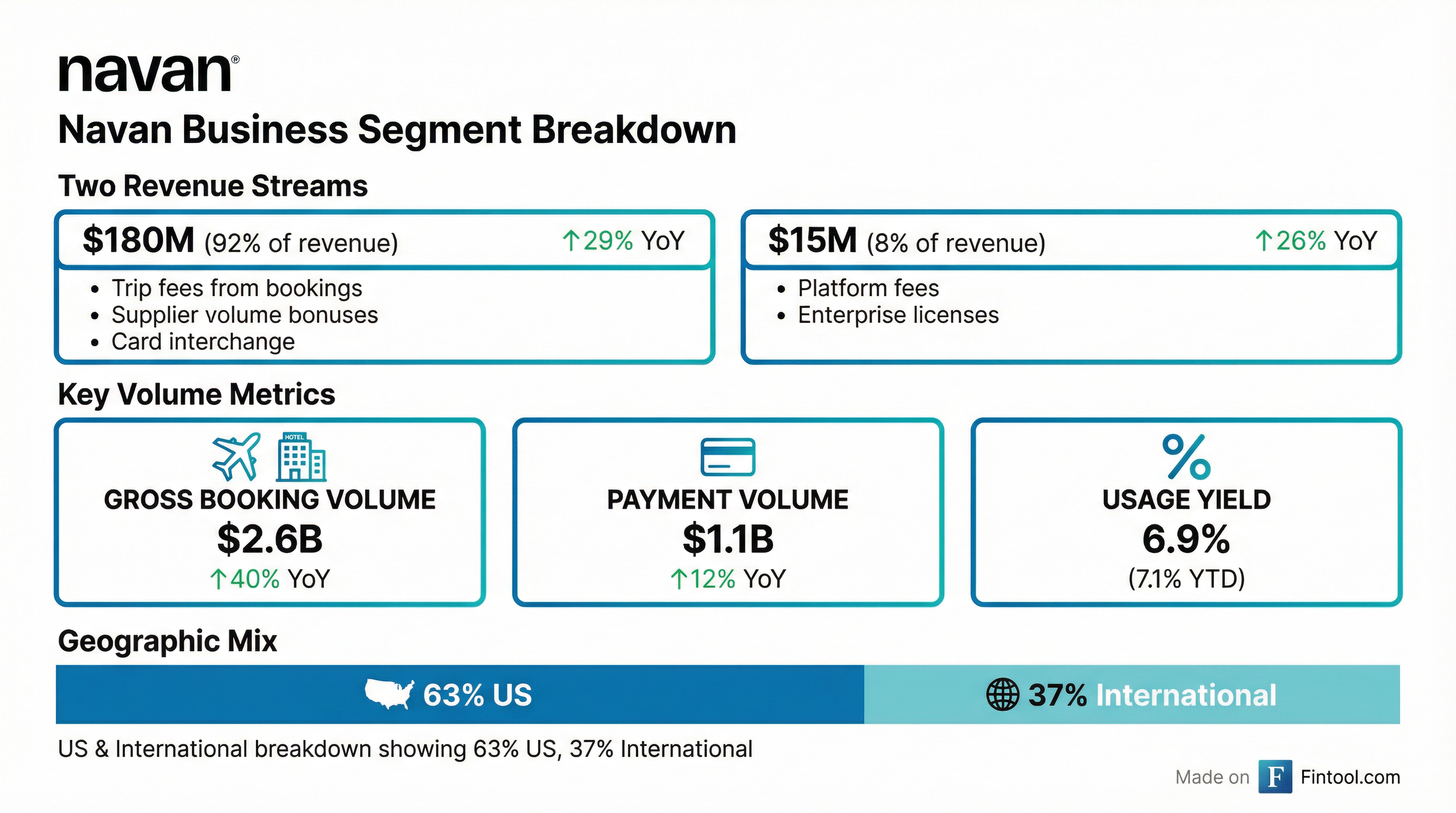

Revenue Mix & Segments

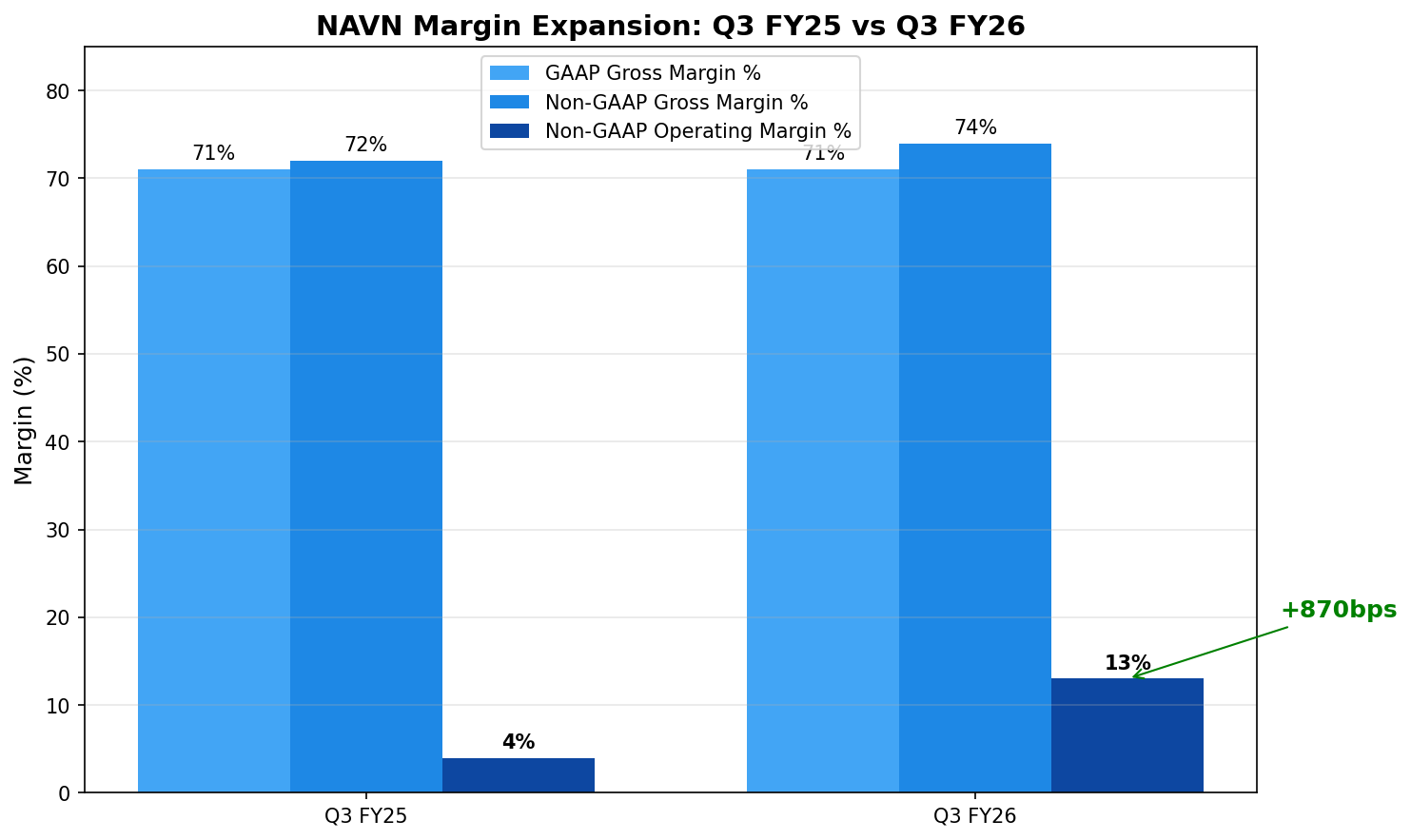

Margin Expansion

AI-driven efficiency is the key story. Ava, Navan's AI support agent, now deflects 54% of all customer interactions , driving substantial cost leverage.

*GAAP decline due to $97M debt extinguishment loss and $99M stock-based compensation from IPO

Stock Reaction

CFO Transition

The elephant in the room: Amy Butte will depart as CFO effective January 9, 2026 .

- Interim CFO: Anne Giviskos (current SVP Strategic Finance & CAO)

- Search: Board conducting search for permanent replacement

- Transition: Butte will serve as strategic advisor through May 2026

- Exit Package: $3.7M cash payment plus accelerated vesting

"I am pleased to have achieved my goals at Navan, including helping to complete Navan's IPO, and wish the company and its leadership team continued success." — Amy Butte

What Went Well

Enterprise Momentum

- Second-largest European deal in company history with a CAC40 company

- Major wins: Visa, Frasers Group, Axel Springer, Engie

- Enterprise customers signing multiple products at launch

"Visa, world leader in digital payments, chose us as they seek to provide an innovative experience and high service levels for Visa's travelers globally." — Ariel Cohen, CEO

Customer Satisfaction at All-Time Highs

AI Leadership

- Ava AI deflection rate: 54% (up from prior periods)

- Satisfaction with AI support at "human levels"

- Navan Edge in development — next-gen AI booking experience

"Only Navan can do this today because only Navan built Cognition." — Ariel Cohen

What Went Wrong

CFO Departure Timing

- Announced same day as first public earnings

- Creates leadership uncertainty during critical post-IPO period

- Board search adds execution risk

Stock Performance

- Down 27% from IPO in ~6 weeks

- After-hours reaction negative despite revenue beat

- IPO priced at premium that hasn't held

GAAP Losses Remain Substantial

Driven by: $97M debt extinguishment loss, $103M stock-based compensation, $29M fair value adjustments

Guidance

Q4 FY2026 (Ending Jan 31, 2026)

Full Year FY2026

FY2027 Commitment

- Free cash flow positive

- Investment year for Navan Edge and payments

Management Commentary

On Results

"Q3 was a strong debut quarter as a public company for Navan. All parts of the business performed well, highlighted by continued momentum in the enterprise market and new highs in customer satisfaction." — Ariel Cohen, CEO

On AI Strategy

"AI has been at our core since our earliest days when we built machine learning to personalize inventory. When LLMs emerged, we immediately recognized the opportunity, but also the limitations. Travel is not answering a password reset. Travel is dynamic, personal, and high-stakes. Mistakes have real consequences." — Ariel Cohen

On Competitive Position

"Anytime we see consolidation, anytime we see uncertainty across the competitive spectrum, anytime we see particularly legacy players questioning where they stand in the marketplace, that is basically a signal that Navan is taking share." — Amy Butte

On Seasonality

"As a reminder, we are a seasonal business. While we are reporting Q3 today, which is our seasonally strongest quarter, when we think about our business we think about it annually over an entire fiscal year." — Amy Butte

Q&A Highlights

On Enterprise Deal Scope

"When we are saying that we won an enterprise, it means the entire enterprise globally. A company like Engie, with a market cap of $30 billion, this is for the entire 15,000 employees." — Ariel Cohen

On Government Shutdown Impact

"We did not see a slowdown in October. October was actually a record month... about four days of slowdown versus what we anticipated before Thanksgiving, which was right about November 11th when the FAA actually restricted the number of planes." — Amy Butte

On Visa Win

"The adoption is really fast. They're ramping much faster than we expected, which validates their enthusiasm." — Amy Butte

On Competitive Moat

"Anybody can make an itinerary using AI, but not everyone can make the AI into an actual booking and into an actual experience. You need the whole integrated platform to do that." — Amy Butte

Balance Sheet Snapshot (Oct 31, 2025)

IPO proceeds significantly strengthened balance sheet

Key Takeaways

- Revenue beat matters — 5% beat on first quarter as public company validates model

- Margin story is real — 870bps non-GAAP operating margin expansion YoY driven by AI

- CFO departure creates overhang — Timing unfortunate, search adds uncertainty

- Enterprise momentum accelerating — CAC40, Visa, Axel Springer wins prove enterprise relevance

- Seasonal business — Q4 will be weaker; full-year view more important

- Path to profitability clear — FCF positive commitment for FY27

Recent Business Highlights

- Forrester TEI Study: 376% ROI with Navan over 3 years, 16% travel spend savings

- Emirates NDC live, Qantas NDC upgraded

- New multi-city booking flow with mixed provider capabilities

- 36% of customers now attach 3+ products

Links

- Company Profile: /app/research/companies/NAVN

- Transcript: /app/research/companies/NAVN/documents/transcripts/Q3-2026

- 8-K Filing: SEC EDGAR

- Investor Relations: investors.navan.com